Airline Sector Soaks Up $10b Loss - AFRICAN AIRLINES ASSOCIATION - How to Attract Private Finance to Africa's Development - Bizweek

←

→

Transcription du contenu de la page

Si votre navigateur ne rend pas la page correctement, lisez s'il vous plaît le contenu de la page ci-dessous

OPPORTUNITY

How to Attract

Private Finance to

Africa’s Development

ÉDITION 347 – VENDREDI 18 JUIN 2021 L’HEBDOMADAIRE DIGITAL GRATUIT

L’ HEBDOMADAIRE ÉLECTRONIQUE GRATUIT

AFRICAN AIRLINES ASSOCIATION

Airline Sector

Soaks Up $10b LossVENDREDI 18 JUIN 2021 | BIZWEEK | ÉDITION 347 3

BIZ ALERT

DANS UN CONTEXTE DE RALENTISSEMENT POST-PANDÉMIE

Les investisseurs sur le marché de la

dette privée doutent de leur capacité

à gérer les défauts de paiement

Une nouvelle étude d’Ocorian montre que 87 % des investisseurs sur les marchés de capitaux mettent en œuvre une stratégie de prêts directs.

Cependant, moins de la moitié des sociétés en Afrique sont confiantes en ce qu’il s’agit du suivi des clauses restrictives de la dette (44 %), des capacités

en matière de lutte contre le blanchiment de capitaux (48 %) ou de recouvrement des pertes (48 %)

U ne grande majorité (87 %) des

investisseurs sur les marchés de

capitaux mettent en œuvre des

stratégies de prêts directs, même si 47 %

d’entre eux ne croient pas en leur capac-

œuvre.

Avec 207 milliards de dollars ayant été

déployés par 327 fonds de prêts directs à

travers le monde au cours des dix dern-

ières années, l’étude souligne le manque

pour évaluer leur préparation opération-

nelle alors qu’ils planifient les stratégies

d’investissement pour l’après-pandémie.

Les sondés issus de sociétés comptant

moins de 10 ans d’existence sont moins

ité à gérer le recouvrement des pertes, ce de confiance qui règne parmi les investis- confiants quant à leur capacité à recou-

qui pourrait avoir de graves implications seurs sur le fait que leur capacité de prêts vrer les pertes en ce qui concerne le prêt

si les défauts de paiement des entreprises directs soit suffisante pour surmonter les direct. Seulement 41 % d’entre eux ont

augmentent à mesure que les politiques de difficultés. Ils sont le moins confiants pour exprimé leur confiance. Le niveau de con-

soutien, mises en place par les gouverne- traiter le recouvrement des pertes (47 %), fiance concernant les capacités de recou-

ments en raison de la pandémie, sont sup- l’évaluation des risques (53 %), la produc- vrement des pertes était le plus bas parmi

primées. tion de relevés (54 %) et le suivi des claus- les sondés européens (28 %) – nettement

Selon le Capital Markets report, intit- es restrictives de dette (57 %). inférieur aux sondés nord-américains (40

ulé ‘Navigating CovExit : Searching for %), africains (48 %) et asiatiques (72 %).

value in the debt markets’, commandité Confiants par rapport Malgré leurs préoccupations, quelque

par Ocorian, leader mondial des services

fiduciaires aux entreprises, de la gestion

aux opportunités 92 % des sondés s’attendent à ce que les

faillites d’entreprises et les restructurations

de fonds d’investissement et des services présentent des opportunités pour eux au

Ocorian a commandité une étude in-

pour marchés de capitaux, la majorité des cours des 12 prochains mois, dont 22 %

dépendante auprès de 100 décideurs sur

investisseurs sur les marchés de capitaux qui pensent que les opportunités seront

les marchés de capitaux travaillant dans

(57 %) ont une stratégie de prêts directs importantes. À l’échelle régionale, les

des banques d’investissement et des so-

qu’ils envisagent d’étendre et 30 % ont une firmes en Afrique étaient plus confiantes

ciétés financières privées en Europe, en

stratégie qu’ils sont en train de mettre en (96 %) par rapport à ces opportunités.

Amérique du Nord, en Afrique et en Asie

makes searching simple

Official online directory of Mauritius Telecom

Business PeopleVENDREDI 18 JUIN 2021 | BIZWEEK | ÉDITION 347 4

LA TOUR

AFRICAN AIRLINES ASSOCIATION

Airline Sector

Soaks Up $10b Loss

The airline industry in Africa recorded a passenger revenue loss of about $10.21 billion for the year 2020, with passenger numbers dropping from 95

million in 2019 to 34.7 million in 2020, representing a year-on-year decline of 63.7 percent. The published its impact assessment analysis on June

2, giving an in-depth analysis of the continent’s air industry performance for 2020, showing that the carriers will continue to lose money in 2021,

F

although it is expected to reduce to about $8.35 billion

rom the end of March, the ma-

jority of carriers grounded their

aircraft causing a drastic seat and

revenue per kilometre drop of

85 percent and 94 percent re-

spectively in April. The reduction in traffic

continued until June, before reversing with

the gradual opening of borders. The survey

entitled ‘Air Transport Report 2020’ also

found that African airlines carried more do-

mestic traffic in 2020, making 43 percent of

their total traffic.

“The leading carriers in terms of domestic traffic

are airlines like Safair, Ethiopian Airlines, Mango

Airlines, and Air Algerie. Those five airlines car-

ried 4.8 million passengers on domestic routes during

the year. International traffic represented 57 percent

breaking down into 19 percent of Intra-African

and 38 percent of intercontinental passengers”, can

we read in the report of the African Airlines

Association (AFRAA).

Europe is the major international destina-

tion of African airlines, representing 21 per-

cent and even exceeding Intra African traffic

(19 percent), domestic excluded. Traffic to

the Middle East tended to increase, while

traffic to Asia reduced due to Covid-19.

Lowering airport

charges

Northern Africa leads in passenger num-

bers, representing 36.6 percent of the total

continental traffic, boosted by European

tourists. Eastern Africa is second with a

share of 22.2 percent of the continent’s

market. Domestic and Intra-African traffic

are dominant in this region, both represent-

ing 70 percent of the traffic in 2020.

Southern Africa suffered a 63.6 percent

drop in traffic due to Covid-19 with the re-

gion having only 21 percent of the conti-

nental traffic but its share of domestic mar-

ket grew to 77 percent in the last quarter of

2020, from 66 percent before Covid-19.

Central and Western African regions both

represented 19.7 percent of the traffic in

Africa.

Johannesburg and Cairo were the busi-

est airports as per landings and take-offs,

with Jomo Kenyatta International Airport

in Nairobi leading ranking by freight traffic

lockdown measures. Mauritius completely

ceased operations during Quarters 2 and 3,

Kenya lead with 30 direct flights and more

to other countries within Africa. However,

REGIONAL INSIGHTS

handling more than 330,000 tonnes in 2020

bringing connectivity level to zero. Airports the intra-African connectivity remains poor. Northern Africa is the leading region in

followed by Cairo’s 280,000 tonnes.

like Madagascar, Lome and Khartoum saw a African airlines should take the opportuni- terms of passengers, representing 36.6% of

Lusaka has the highest level of charges

quick improvement from the beginning of ty to develop their intra-African Network, the total continental traffic. In this region,

while Mahe Island has the lowest among

Quarter 3, benefiting from less strict restric- especially in this period where the EU has the major part of this traffic is directed out-

the selected airports. Some of the busiest

tions. limited travels to Europe.” side the continent, in particular to Europe:

airports in Africa like Johannesburg, Addis,

In 2020, the regional traffic represented In terms of Visa openness within, more 45% before Covid. This can be explained

Algiers are among the least expensive. This

only 19% of African carriers’ operations. and more countries are opening their bor- by the tourism that is developed in the re-

indicates that lowering the airport charges

Furthermore, the Covid-19 situation deplet- ders to other African countries. In 2010, gion and attracts Europeans. Middle-East is

can have a positive effect on traffic.

ed the Intra-African connectivity that was The Gambia joined Seychelles and Benin also a preferred destination from Northern

already low. It is important to facilitate trav- in the group of totally Visa-free countries.

Removing els within Africa by removing the barriers Visa on arrival is adopted by 32 countries

Africa (22% of the traffic in 2019) due to

barriers that prevent travels within the continent. across Africa. Unfortunately, in 2020, 46%

the strong cultural and economic relation-

ship between the Maghreb and Middle-East.

“Among the 54 countries in the African of Africans still need a visa to travel to an- The Covid-19 outbreak caused a year-on-

Johannesburg remains the most connect- continent, 13 have direct flights to more other African country compared to 50% in year drop of 61% of the regional traffic.

ed airport, even if severely affected by the than 20 African countries. Ethiopia and 2019, which is a small improvement.

Cont’d on page 5VENDREDI 18 JUIN 2021 | BIZWEEK | ÉDITION 347 5

LA TOUR

The traffic toward Europe declined by lated to Covid reached 63.6% compared to

5%, in favor of Middle-East (+2.6%) and 2019. In this region representing 21% of the

intra-Africa (+2.1%). The part of the do- continental traffic, the domestic market is

mestic market is around 20%, which is far clearly dominant: from 66% before the Cov-

from the continental average that is 43%. id, the part of domestic traffic increased up

Eastern Africa is the second region in to 77% in the last quarter of 2020. On the

terms of passenger traffic volumes with a other end, intra-African traffic reduced, as

share of 22.2%. Domestic and Intra-Af- well as traffic outside the continent.

rican traffic are dominant in this region, Central and Western African regions

both representing 70% of the traffic in both represented 19.7% of the traffic in

2020. Europe is the major destination out- Africa. Domestic traffic represented around

side the continent followed by Asia (12% 40% in 2019, Intra-African following with

and 7% respectively). After the beginning 32%. In 2020, with the Covid situation, the

of the Covid crisis, the share of the do- share of domestic increased, particularly in

mestic market rose by 20%. On the oth- the second quarter with 68% with the bor-

er hand, Intra-African traffic reduced by ders closing. The share of Europe, the prin-

10%. Asia also lost some shares, from 8% cipal destination outside Africa reduced from

to 2% from quarter two. 12% in 2019 to 10% in 2020. The traffic to

In Southern Africa, the traffic drop re- Asia also declined from 5.8% to 2.4%.VENDREDI 18 JUIN 2021 | BIZWEEK | ÉDITION 347 6

ACTA PUBLICA

BAROMÈTRE DU COMMERCE DES MARCHANDISES

Une solide reprise du commerce

et l’ampleur du choc provoqué

par la COVID-19

Selon le dernier Baromètre du commerce des marchandises de l’Organisation Mondiale du Commerce publié le 28 mai, le commerce mondial des

L

marchandises continue de se redresser en 2021 après une chute brutale mais brève au deuxième trimestre de l’année dernière en raison de la pandémie

e Baromètre du commerce des

marchandises est un indicateur

avancé composite du commerce

mondial qui fournit des rensei-

gnements “en temps réel” sur

l’évolution du commerce des marchandis-

es par rapport aux tendances récentes. Le

niveau actuel du baromètre — de 109,7 —

est supérieur de près de 10 points à la valeur

de base de 100 de l’indice et a augmenté

de 21,6 points en glissement annuel, ce qui

dénote à la fois la vigueur de la reprise act-

uelle et l’ampleur du choc provoqué par la

COVID-19 l’année dernière.

Au cours du dernier mois, tous les indices

constitutifs du baromètre étaient supérieurs

à la tendance et en hausse, soulignant la na-

ture généralisée de la reprise et signalant une

accélération du rythme de l’expansion du

commerce.

Parmi les indices constitutifs du baromè-

tre, les augmentations les plus marquées

ont été observées pour les commandes à

l’exportation (114,8), le fret aérien (111,1),

et les composants électroniques (115,2),

qui ont tous une forte valeur de prédiction

des tendances à court terme du commerce.

La vigueur de l’indice relatif aux produits

automobiles (105,5) pourrait refléter une

amélioration du moral des consomma- La plus grave menace merce des services qui reste faible et par des

calendriers de vaccination qui prennent du

dante de 2019.

Bien que les statistiques trimestrielles du

teurs, la confiance étant étroitement liée aux

ventes de biens durables. C’est également le La dernière lecture du baromètre est large- retard, notamment dans les pays pauvres. volume des échanges pour les premier et

cas des matières premières agricoles (105,4), ment conforme aux prévisions commerciales Le commerce mondial se redresse depu- deuxième trimestres de 2021 n’aient pas en-

qui sont principalement constituées de bois actuelles de l’OMC publiées le 31 mars, qui is le deuxième trimestre de 2020, lorsque core été publiées, elles devraient afficher une

destiné à la construction de logements. En- prévoyaient une reprise de 8% du volume la propagation du virus de la COVID-19 a très forte croissance en glissement annuel, en

fin, la bonne performance du transport par du commerce mondial de marchandises en provoqué des confinements dans de nom- raison du récent renforcement des échang-

conteneurs (106,7) est d’autant plus impres- 2021, après une baisse de 5,3% l’année précé- breux pays et déclenché une chute brutale du es d’une part et de l’effondrement du com-

sionnante que les expéditions maritimes ont dente. Les perspectives relativement positives commerce mondial. Le volume des échanges merce l’année dernière d’autre part. Cepend-

bien résisté à la pandémie et ont donc eu à court terme du commerce sont assombries de marchandises avait baissé de 15,5 % en ant, la COVID-19 continue de représenter

moins de terrain à rattraper. par des disparités régionales, par un com- glissement annuel au deuxième trimestre, la plus grave menace pour les perspectives

quand les confinements étaient pleinement commerciales, car la reprise pourrait être fac-

effectifs, mais au quatrième trimestre, il avait ilement compromise par de nouvelles vagues

dépassé le niveau de la période correspon- d’infection.VENDREDI 18 JUIN 2021 | BIZWEEK | ÉDITION 347 7

POST SCRIPTUM

ABEBE AEMRO SELASSIE OPPORTUNITY

is the Director of the IMF’s

African Department.

LUC EYRAUD is Advisor

and Mission Chief in the

How to Attract Private Finance

IMF’s African Department.

CATHERINE PATTILLO

is a Deputy Director in the

to Africa’s Development

IMF’s African Department. African economies are at a pivotal juncture. The COVID-19 pandemic has brought economic

activity to a standstill. Africa’s hard-won economic gains of the last two decades, critical in im-

proving living standards, could be reversed. High public debt levels and the uncertain outlook

for international aid limit the scope for growth through large public investment programs. The

private sector will have to play more of a role in economic development if countries are to enjoy

a strong recovery and avoid economic stagnation. Heads of state from Africa made this one of

their resounding messages during the recent summit on “Financing African Economies” held in

Paris in May

Exit risk. No investor will enter a country

if they don’t have assurances that they can

also exit by selling their stakes in a project

and recouping their gains. Narrow and

underdeveloped financial markets may prevent

investors from exiting by issuing shares.

Capital controls can slow down or increase

the cost of exiting. And, when the legal

framework is weak, investors may get bogged

I

down in legal battles to have their rights

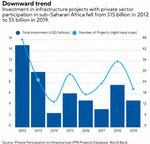

nfrastructure—both physical (roads, 2020 GDP) and almost a quarter of the recognized.

electricity) and social (health, average private investment ratio in the region

education)—is one area where the (currently 13 percent of GDP). Incentivizing private

private sector could be more involved. investment

Africa’s infrastructure development What constrains private

needs are huge--in the order of 20 percent finance now? Improving the business climate is important

of GDP on average by the end of the decade. but not enough. Development sectors have

How can this be financed? All else equal, the At the moment, the private sector is not certain structural features that make private

main source of financing would be more tax involved much in financing and delivering sector participation intrinsically complicated,

revenue collections, something which most infrastructure in Africa, compared to other even in the most favorable environments.

countries are working towards. But, given the regions. Public entities, such as national For instance, infrastructure projects often

scale of the needs, new financing sources will governments and state-owned enterprises, have large upfront costs, but their returns

have to be mobilized from the international carry out 95 percent of infrastructure accrue over long periods of time, which can be

community and the private sector. projects. The volume of infrastructure difficult for private investors to assess. Private

Africa is a continent that holds immense projects with private sector participation sector growth also thrives on networks and

opportunity for private investors. It has a has significantly declined in the past decade, value chains, which may not yet exist in new

young and growing population and abundant following the commodity price bust. The markets.

natural resources. Cities are seeing massive limited role of private investors is also When these problems are acute, governments

growth. Many countries have launched apparent from an international comparison may have to provide extra incentives to make

long-term industrialization and digitalization perspective: Africa attracts only 2 percent infrastructure projects attractive to private

initiatives. But significant investment and of global flows of foreign direct investment. investors. These incentives, which comprise

innovation are necessary to unlock the And when investment does go to Africa, it various types of subsidies and guarantees,

region’s full potential. Recent research is predominantly to natural resources and can be costly and carry fiscal risks. But the

published by IMF staff shows that the private extractive industries, not health, roads or truth is, many projects in development sectors

sector could, by the end of the decade, bring water. won’t happen without them. In East Asia, 90

additional annual financing equivalent to To attract private investors and transform percent of infrastructure projects with private

3 percent of sub-Saharan Africa’s GDP the way Africa finances its development, participation receive government support.

for physical and social infrastructure. This improvements in the business environment With certain design features, governments can

represents about $50 billion per year (using seem critical. Our research shows that three maximize the efficiency and impact of public

key risks dominate international investors’ incentives, while minimizing risks. Support

minds: should be targeted, temporary and granted

Project risk. Despite Africa presenting a on the basis of proven market dysfunctions.

wealth of business opportunities, the pipeline It should also be transparent, leave

of projects that are truly “investment-ready” sufficient risk to private parties, and display

remains limited. These are projects sufficiently additionality, meaning that incentives should

developed to appeal to investors that do not make worthy projects happen that would not

want to invest in early-stage concepts or happen otherwise. Finally, their size should be

unfamiliar markets. Financial and technical well calibrated to avoid overcompensating the

support by donors and development banks can private sector.

help countries fund feasibility studies, project Given the limited availability of public funds,

design and other preparatory activities that African countries and development partners

expand the pool of bankable projects. could consider reallocating some resources

Currency risk. Imagine that a project yields a used for public investment towards financing

return of 10 percent a year, but the currency public incentives for private projects. When

depreciates by 5 percent at the same time--this this reallocation is gradual and supported

would eliminate half of the profits for foreign by sound institutions, transparency and

investors. No wonder currency risk is a top governance, it could increase the amount,

concern for them. Prudent macroeconomic range, and quality of services for people

policy combined with sound foreign exchange in Africa. More innovative thinking can

reserve management can greatly reduce help realize the transformative potential of

currency volatility. infrastructure on the continent.VENDREDI 18 JUIN 2021 | BIZWEEK | ÉDITION 347 8

DEBRIEF

ORGANIZATIONAL INTEGRITY INDEX (OII)

Autism Maurice says Thank You

Better perception of In view to ensure a better-quality health care for many Autis-

tic Mauritians, on Friday 11 June 2021, in budget 2021-2022(290

C), the Government has announced an amount of the public health

MRA’s Integrity

budget which will cater for “Upgrading works and setting up of day

care wards for autistic children at the five regional hospitals”. Ac-

cording to the World Health Organisation, about 1 in 160 children

has ASD. Autisme Maurice founded in November 2009, has been

creating awareness and providing Special Need Education to au-

The fourth survey on the perception of integrity at the Mauritius Revenue Authority tistic children. We believe in an Inclusive Society. Autisme Maurice

(MRA) demonstrated once again that the institution is moving in the right direction would like to thank the Government and the Minister of Finance

for the efforts he has made to facilitate the life of the Autistic indi-

to achieve its ultimate goal of being a world-class tax administration respected for its viduals. This is a great relief for parents and the individuals on the

professionalism, efficiency, equity, its integrity and its contribution to the socio-eco- spectrum. It is a long fight over years, started by late Mrs Geraldine

Aliphon, and the show must go on.

nomic development of the Republic of Mauritius

T his survey, conducted by

the firm Economic &

Management Consultants

Ltd among MRA’s stakeholders

and the public in general, aimed

zational Integrity Index has im-

proved, compared to the last ex-

ercise carried out in 2016. It went

from 73.9 in 2016 to 76.3 in 2021.

According to MRA staff, the de-

initiatives it has implemented in

recent years. In its organization-

al structure, the Internal Affairs

Division and the Internal Audit

division are respectively respon-

Collectes à Phoenix :

Chaque Mauricien donnant

son sang peut sauver trois vies

at assessing their perception of in- partments that enjoy the highest sible for staff integrity and good Chaque pinte

tegrity at the MRA. It was based level of integrity are the Internal governance. The MRA has its own donnée peut sauver

on the following six dimensions of Audit Department (IAD), the code of conduct and ethics, an ob- trois vies. Devant le

integrity: (i) the legal framework, Operational Services Department ligation of its employees to submit manque drastique

regulatory and institutional, (ii) (OSD), the Large Taxpayers De- a declaration of assets every three de pintes dans nos

leadership, (iii) internal controls, partment (LTD) and the Informa- years, a declaration of integrity banques de sang,

(iv) staff attitude and behaviour, tion Systems Department (ISD). policy, a guide on “gifts” and the plusieurs entités

(v) its relationship with external In contrast, the business segment obligation to report assets. New se sont regroupées

stakeholders and (vi) the automa- assigns the highest integrity rating strategies such as the Corruption pour organiser une

tion and reforms within the Or- to Customs. Risk Mapping (CRM) have been collecte à Phoenix,

ganisation. This result is highly encouraging developed to identify the risks of dans le cadre de la

The report, submitted in May result for the MRA, and is indica- corruption and take measures to Journée mondiale

2021, reveals that the Organi- tive of the success of the various counter them. du donneur de sang.

Blast BCW, le Cen-

tre International

Wellkin Hospital by C-Care réalise sa première de Développement

Phar maceutique

discectomie lombaire par voie endoscopique (CIDP), le groupe

Socota, Jumbo et

C’est une première médicale à ble pour qu’elle puisse reprendre ses ac- Phoenix Mall ont

Wellkin Hospital, et une excellente tivités et surtout, ne plus souffrir de son invité, ainsi, les

nouvelle pour les patients souf- dos. Après une IRM, nous avons opté Mauriciens à faire

frant d’une hernie discale. L’équipe pour une discectomie lombaire par voie ce don de soi si

de chirurgiens de Wellkin Hospital, endoscopique. Il s’agit d’une chirurgie précieux à la survie

dirigée par le Dr S. Karunagaran, mini-invasive de la colonne vertébrale qui des malades. Deux caravanes de la Banque de sang étaient postées à

a opéré avec succès une patiente présente de nombreux avantages pour les Socota Phoenicia (Biopark) et à Phoenix Mall, le mercredi 16 juin,

en effectuant une discectomie patients. Nous effectuons de plus en plus entre 9 et 15 heures.

lombaire par voie endoscopique. d’interventions en utilisant cette technique

L’opération a eu lieu le samedi, 22 novatrice. Jusqu’à tout récemment, les pa- Football : Place à la 47e édition de la

mai 2021. tients mauriciens se tournaient vers des

« La patiente souffrait de douleurs centres de santé à l’étranger pour en béné- COPA AMERICA sur CANAL+

lombaires qui s’étaient aggravées au fil ficier », explique le Dr S. Karunaga- Les plus grandes équipes de football d’Amérique du Sud se réunis-

du temps et avaient atteint un point où ran, Senior Consultant – spécialiste sent sur les chaînes CANAL+ SPORT pour la COPA AMERICA

elles affectaient gravement sa mobilité. en orthopédie et chirurgie rachidi- 2021. Ainsi, du 13 juin au 11 juillet, l’intégralité des matchs sera

La chirurgie était le seul recours possi- enne au Wellkin Hospital. diffusée sur les chaînes CANAL SPORT 3 et CANAL+ SPORT 4

en direct et en haute définition. Dix équipes d’Amérique du sud

s’affronteront lors de ce championnat, qui se déroule cette année au

Brésil avec les plus grands joueurs de football, tels que Lionel Messi,

Constance Belle Mare Plage : La créativité Sergio Agüero, Dani Alves, Thiago Silva, Philippe Coutinho, Ga-

briel Jesus et Luis Suárez entre autres… Les abonnés peuvent aussi

au service du développement durable visionner toutes les rencontres en mobilité et quand ils le veulent, à

travers l’application myCANAL.

La formation est au cœur de la politique environne-

mentale de Constance Hotels & Resorts. Grâce à son

programme Constance BRIGHT, le groupe hôtelier a mis

en place plusieurs projets de revalorisation des déchets

à travers lesquels les employés ont pu faire preuve de

créativité. Fidèle à sa devise « True by Nature », le groupe

compte encourager davantage ce type d’activités auprès de

ses équipes, qui demeurent au centre de son engagement

en faveur de la préservation de l’environnement. Au Con-

stance Belle Mare Plage, des employés ont réalisé deux

projets pour recycler des copeaux de savon et des bou-

gies usagées. En effet, finalisé en février dernier, le projet

« Coco bougie » consiste à fabriquer à la main des bougies

écologiques en re-

cyclant des bou-

gies chauffe-plat

qui sont utilisées

dans les spas. Il

s’agissait d’un tra-

vail d’équipe im-

pliquant les dépar-

tements chargés

de l’entretien et

de l’aménagement

paysager.Vous pouvez aussi lire